Understanding your CP288 notice - Internal Revenue Service

CP288 tells you we accepted your election or treatment as a Qualified Subchapter S Trust (QSST).

Part III Administrative, Procedural, and Miscellaneous 26 CFR 601.105: Examination of returns and claims for refund, credit or abatement; determination of correct tax liability. (Also Part I, § 1361; …

ETS2 mods | Euro truck simulator 2 mods - ETS2MODS.LT

2 days ago · If that‘s the case - Euro Truck Simulator 2 or just ETS 2 game is what you need. With the ets2 mods avaliable to download for free in our site you can add new trucks, maps, sounds, cars and …

GTA5-Mods.com - Your source for the latest GTA 5 car mods, scripts ...

Discover and download the latest GTA 5 mods, including vehicles, scripts, and more, to enhance your gaming experience.

Qualified Subchapter S Trust (QSST) - Brown Law PLLC

Jan 4, 2025 · A Qualified Subchapter S Trust (QSST) is a specialized trust allowing an individual beneficiary to receive S Corporation income, ensuring tax efficiency and compliance.

QSST election - Wikipedia

In United States federal income tax law, a qualified Subchapter S trust is one of several types of trusts that may retain ownership as the shareholder of an S corporation. The beneficiary of such a trust …

What Is a QSST Trust for an S Corporation? - LegalClarity

Jan 24, 2026 · Understand how a Qualified Subchapter S Trust (QSST) allows S corporation stock to be held in a trust while maintaining tax status. Learn the key requirements and setup process.

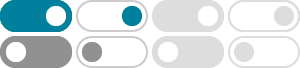

Releases · hustlei/QssStylesheetEditor - GitHub

Editor for qt stylesheet (qss). Real-time preview, and user can define varibles in qss. - hustlei/QssStylesheetEditor

Qatar School of Science and Technology, Building 82, Street 868, Umm ...

Jan 22, 2026 · Our school uses EduPage school information system. Login with your account to see grades, your timetable, current substitutions, check your homework and daily plan for the next day.

Using qualified Subchapter S trusts (QSSTs) - The Tax Adviser

Dec 1, 2017 · The QSST may be useful for estate planning purposes and for holding S stock for the benefit of a minor or incompetent.